- August 20, 2015

- limerock

- Articles

- No Comments

Many folks who are seeking reliable housing often ponder this age old question, and honestly, the most appropriate answer varies. There is a myriad of different factors that weigh into real estate transactions including current mortgage rates, income tax brackets, expected maintenance costs, recent market activity, and area growth trends.

Although there are pros and cons to both renting and buying, let’s take a look at what someone in the Triad area might consider when debating these two housing options.

The average starter home in North Carolina will not be over $150,000 and usually falls under $100,000, especially in our area. The current growth rate for our state is approximately 5.7%, and mortgage rates vary, but are currently falling around 3.7%.

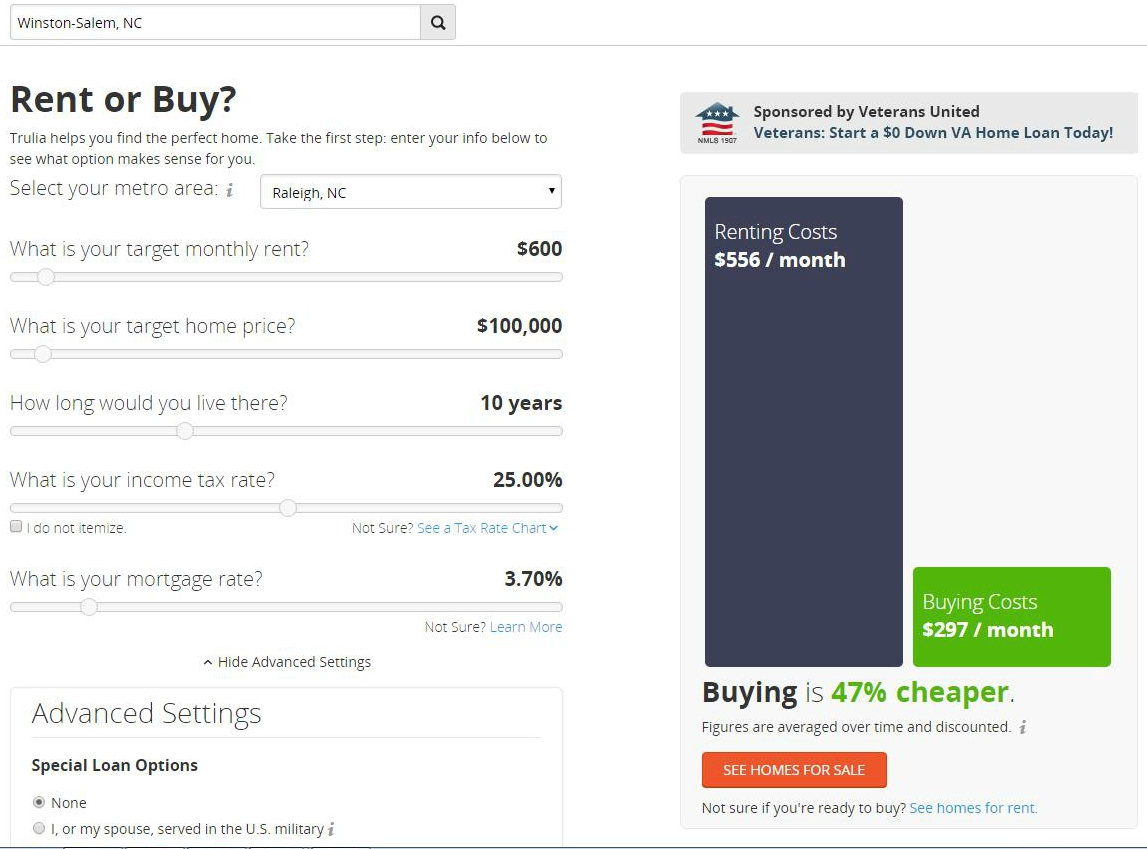

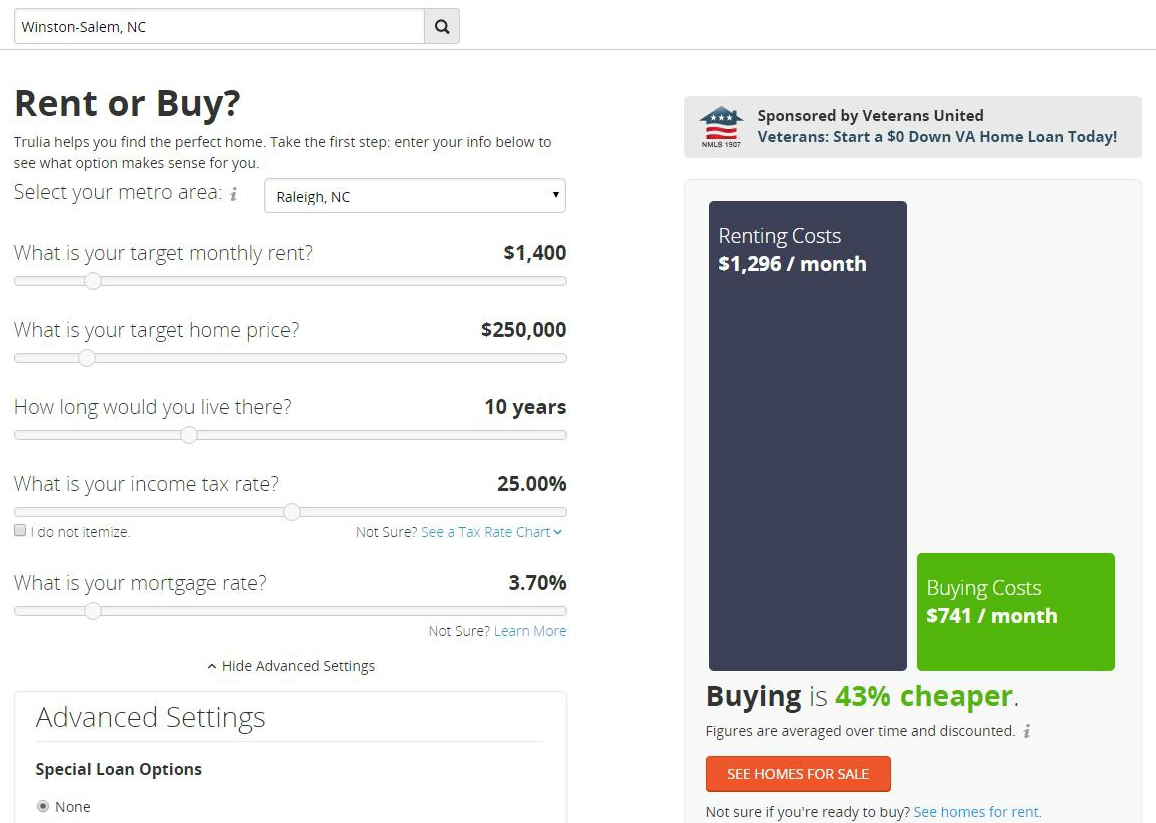

Trulia has a really simple calculator (http://www.trulia.com/rent_vs_buy/) that helps shoppers evaluate their current situation and determine whether buying or renting is the most economic choice. The New York Times also features a more detailed system if your personal needs are slightly more complex.

Plugging in the statistics for our area, and even doing so conservatively, is quite informative!

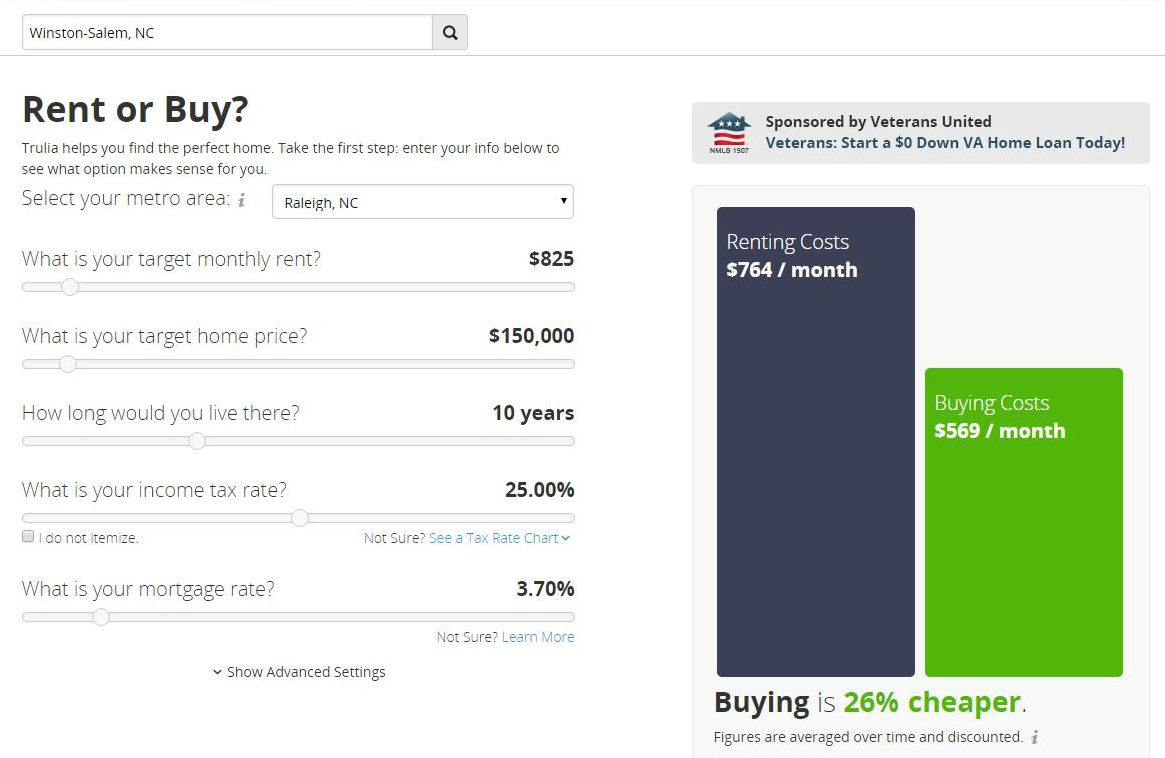

Average home price/Average Rent

$825 is the average rental rate for a well maintained, relatively newer 3 bedroom, 2 bath, single family home in Winston-Salem. $150,000 is a slightly higher (conservative) estimation for the purchase price of a home that falls within this rent range.

**Why is the rent in the graph lower than the target rent range on the left? This is assuming that tenants will receive their security deposit back at the end of their lease.**

As you can see in the graph above, buying is not only cheaper than renting (in the long run) but buying a home establishes equity and helps to build credit.

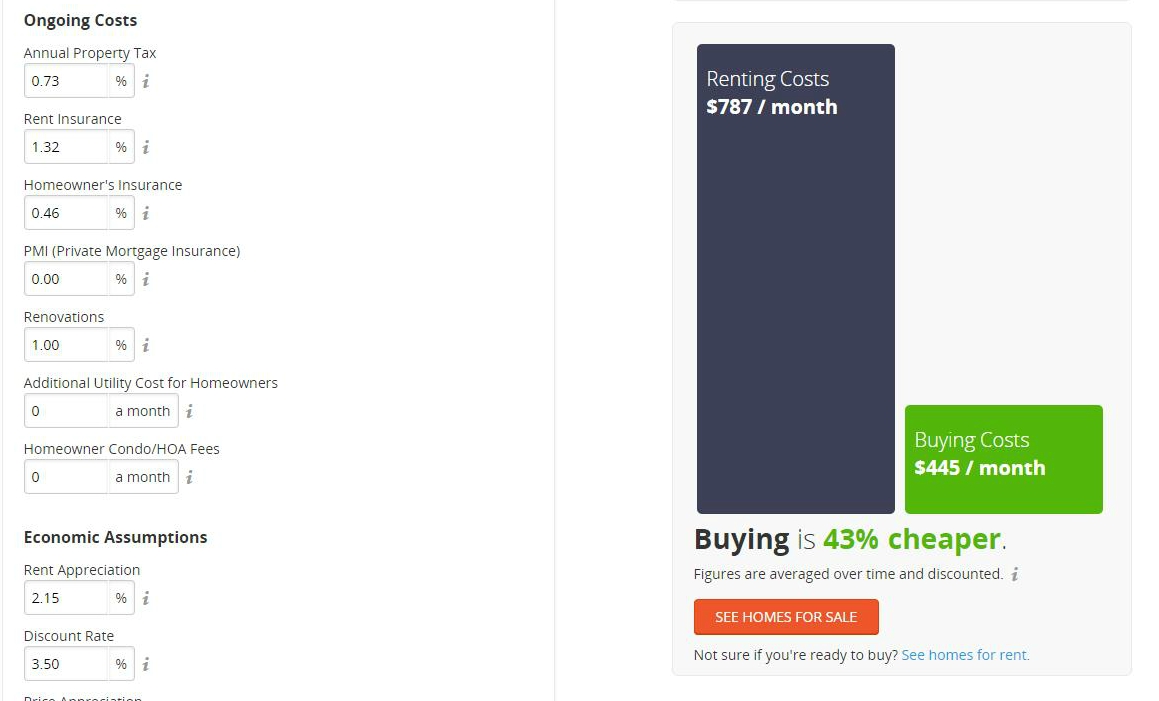

Using the advanced settings on Trulia’s calculator, this site assumes that most rental properties in our area cover approximately $100/month in maintenance and utilities. Typically, however, renters in single family homes are expected to cover all utilities. In other words, renters and owners in this area will pay the same amount each month for extraneous utilities like power, cable, internet, and water. When utilities are the same regardless of whether you rent or buy, the comparison looks a little like this:

Average Home Price with Comparable Utilities to Renting

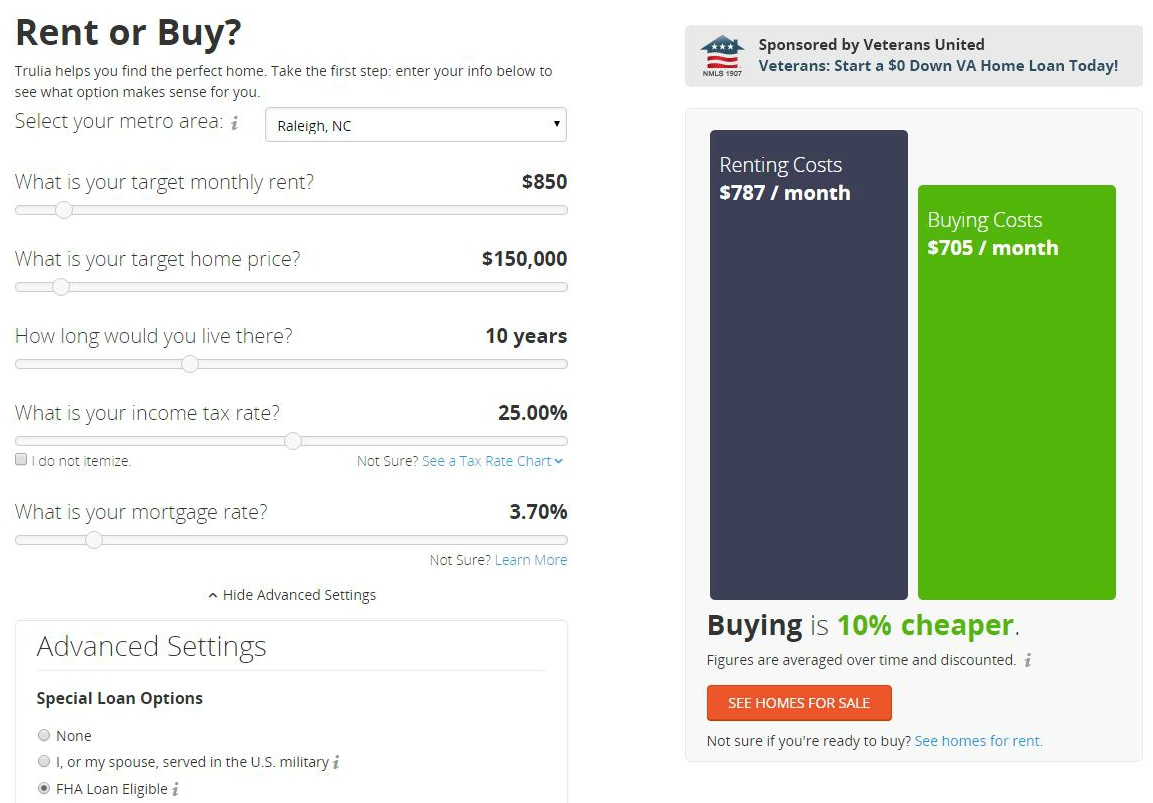

Qualifying for a loan and providing a down payment are perhaps the most two pivotal aspects of buying instead of renting. Luckily, even shoppers who may not have a substantial down payment available, could still potentially qualify for an FHA loan.

Average Home Price with FHA Loan

Although FHA loans do not require a hefty down payment, they do require an upfront mortgage insurance premium as well as annual rates that are based on a comparison of the value of the home and the loan amount. For more information about FHA loans, check out Zillow’s informative article here. Although FHA loan status might increase the monthly, up front buying costs, using the average statistics for Winston-Salem, NC, buying with an FHA loan is still more cost effective than renting.

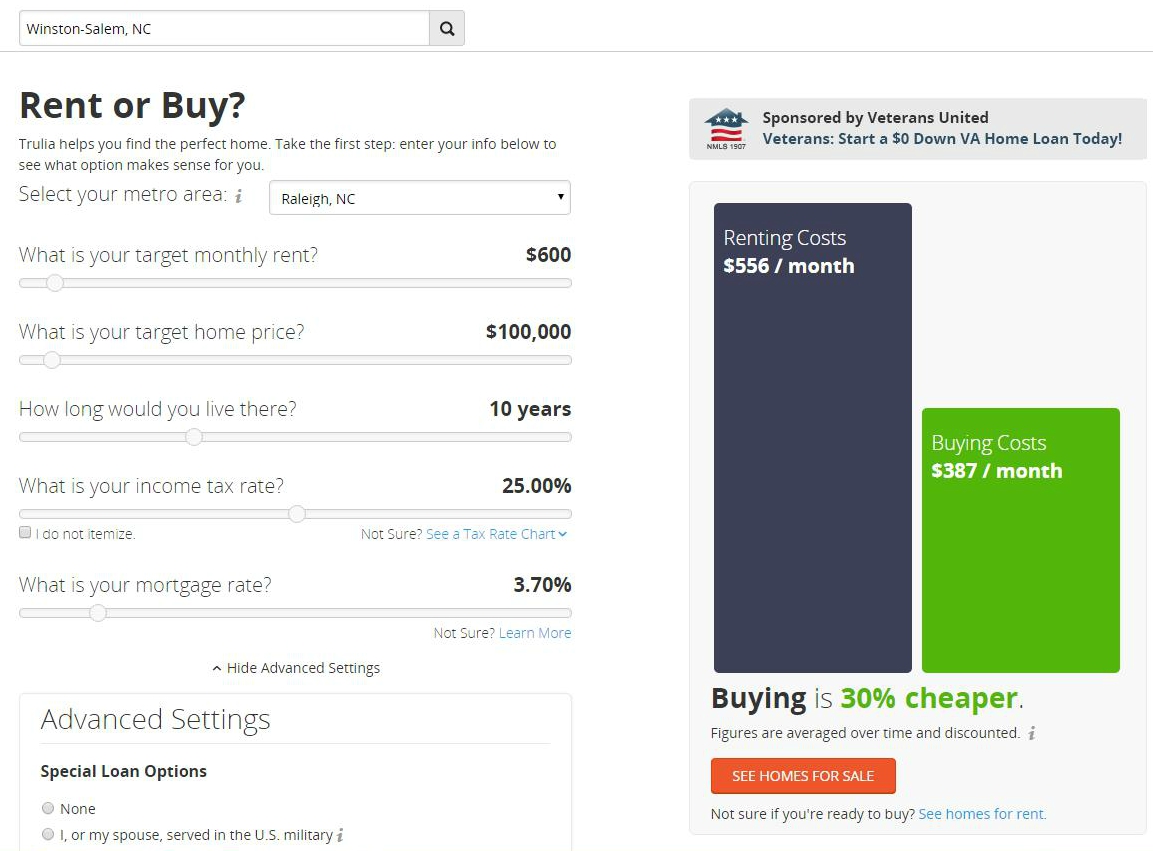

Even when you reduce the expected rent and purchase price to accommodate a smaller budget, buying is ultimately the most cost effective choice when it comes to the long term investment of a home.

Affordable Home WITH FHA Loan

If you’d like to work within a smaller budget, but still have the means (down payment and credit) to purchase using a traditional loan, the buying costs are even less:

Affordable Home/Typical Loan

Working with a higher budget? The graph still shows home buying to be the most cost effective choice of housing in our area at this time.

Nicer Home/Typical Loan

Check out Trulia’s calculator (http://www.trulia.com/rent_vs_buy/) for yourself, and give Lime Rock Realty a call if you are considering making a change to your current housing situation. We would be delighted to help you take the next steps to home ownership.